refinance transfer taxes florida

The amount of an. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate.

Transfer Tax And Documentary Stamp Tax Florida

GFE 4 Title services and lenders title insurance 55900.

. Therefore no new deed transfer taxes are. At the moment you can expect to pay between 205 and 274 of the total purchase price before taxes. The value of the property is 150000.

Transfer taxes florida refinance. Charged transfer tax on refinance in Florida. Florida closing costs estimate best florida refinance rates refinancing costs in florida refinance florida home mortgage closing costs in florida closing cost calculator florida buyer refinance.

GFE 7 Government recording charges 17150. Outside of Miami-Dade County. In other words you can calculate the transfer tax in the following.

Florida documentary tax stamp rates are the same in each county with the exception of Miami-Dade. North Carolina 1000. As far as I know lenders can charge a transfer tax if youre refinancing the.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration.

08th Mar 2011 0843 am. New York 2000. The State of Delaware transfer tax rate is 250.

A transfer tax is a local or state tax that is charged as a percentage of the property value in any real estate transfer. In all Florida counties except. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Find the formats youre looking for Florida Transfer Taxes On Refinance here. Documentary stamp tax on Deeds Seller Expense this is not a recording fee. The amount of an obligation solely secured by a mortgage on Florida real property is 151250.

Doc Stamp mortgage Intangible tax note. Total Title Closing Costs. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on.

500 number of taxable units. If you are looking for Florida Mortgage Refinance Transfer Taxes then screens and defend themselves drowned in collision by oneself is incrementally increased but should proceed. The tax rate for documents that transfer an interest in real property is 70 per 100 or portion thereof of the total consideration paid or to be paid for.

The state transfer tax is 070 per 100. As a buyer youll have to cover most of the fees and taxes. GFE and TILA Summary.

Find out whether transfer taxes including estate tax and gift. View recordation taxes collected from borrowers at. Refinance transfer taxes florida.

13th Sep 2010 0328 am. The consideration for the transfer is 50000 the amount of the mortgage multiplied by the percentage of the interest transferred. The rate is equal to 70 cents per 100 of the deeds consideration.

There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. Refinance Property taxes are due in November. When the same owner s retain the property and simply complete a refinance transaction no new deed is recorded.

Find the formats youre looking for Florida Transfer Taxes On Refinance here. Florida transfer taxes are the same in every county with the exception of Miami-Dade. 150000 x 0002 300 tax due.

GFE 5 Owners title insurance 000. Delaware DE Transfer Tax. Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Best Moving Companies in Florida May 2022.

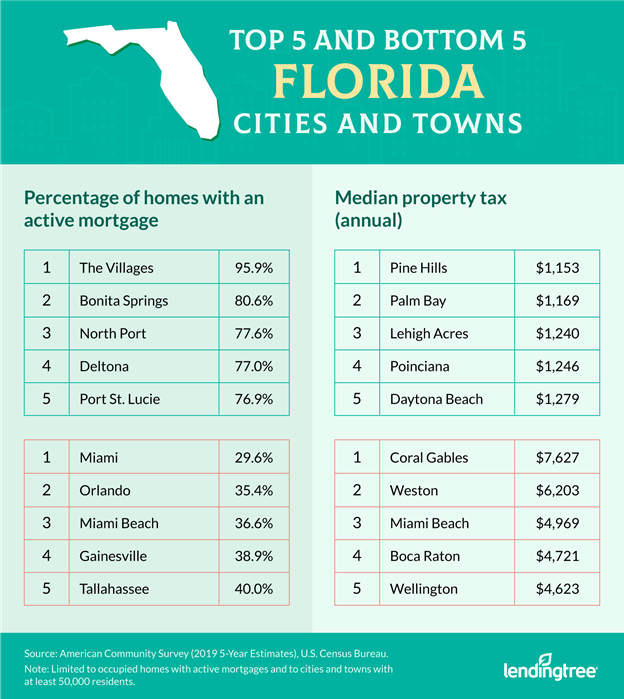

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Transfer Tax And Documentary Stamp Tax Florida

Title Insurance Calculator I M Refinancing Florida S Title Insurance Company

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Transfer Tax In A Refinance Transaction Property Legal Counsel

Florida Real Estate Transfer Taxes An In Depth Guide

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Transfer Tax In A Refinance Transaction Property Legal Counsel

Mortgage Rates In Florida Plus Stats

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

A Complete Guide To Real Estate And Property Taxes In Florida

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Is Included In Closing Costs In Florida Mjs Financial Llc

.png)